Article Summary: Many Forex strategies focus on entry and exit signals of a trade. This

article illustrates how traders can take the same signals, yet arrive

at different profit amounts. Therefore, determining an appropriate

amount of effective leverage is crucial to a comprehensive Forex trading

plan.

Many traders focus all of their energy on finding the right entry and exit signal but still end up losing in the end. Today, I want to illustrate how two traders (Bob and Ed) place the same trading signals in their Forex account, yet end up with different equity amounts.

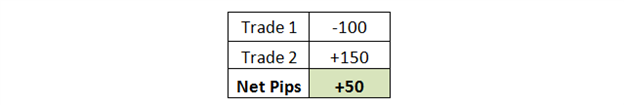

To keep the illustration simple, let’s look at a two trade series. Each trade has a 100 pip stop loss and a 150 pip profit target. The traders will lose on the first trade and win on the second trade. When you see the results on a score card, it would look something similar to this:

Trade results in pips

At the surface level, it looks like this trader is

doing well. They are maintaining a positive risk to reward ratio, they

have a good win ratio, and the number of pips collected on this series of two trades are positive 50 pips.

Now look at what happens to the account’s equity when Bob aggressively over leverages his account while Ed uses more conservative amounts of leverage.

Trader Bob

Starting Capital - $10,000

Account is set to 50:1 leverage. He thinks he is conservative and implements 40 times effective leverage.

Trade #

|

Trade Size

|

Value per Pip

|

Trade Result

|

Profit/Loss

|

Acct Equity

| ||

Trade 1

|

400,000

|

40

|

-100

|

-4000

|

6,000

| ||

Trade 2

|

240,000

|

24

|

150

|

3600

|

9,600

|

Hypothetical results for illustrative purposes only.

Notice how Bob’s two trade sequence netted him +50

pips yet he lost $400 in his account. Obviously, the second trade had a

much smaller trade size than the first, but when you over-leverage your

Forex account, any losing trade damages your capital base to the point

where you need to change your trade size or deposit more funds.

Trader Ed

Starting Capital - $10,000

Account is set to 50:1 leverage. Ed has gone through our Forexpathfinder EDU training materials and wanted to trade conservatively. He determined the appropriate amount of effective leverage for him was 5 times.

Trade #

|

Trade Size

|

Value per Pip

|

Trade Result

|

Profit/Loss

|

Acct Equity

| ||

Trade 1

|

50,000

|

5

|

-100

|

-500

|

9,500

| ||

Trade 2

|

47,000

|

4.7

|

150

|

705

|

10,205

|

Hypothetical results for illustrative purposes only.

Ed placed the same trades as Bob and had the same starting account balance as Bob, but Ed implemented a more conservative amount of leverage. His trade sizes were 1/8 the size of Bob’s yet:

- Ed ended up with higher equity relative to Bob

- Ed’s net profit/loss (P/L) was positive while Bob’s P/L was negative

Two points to take away from this illustration.

- When faced with a losing trade, high degrees of leverage destroy your capital base forcing you to change your future trade sizes or deposit more funds.

- When using conservative amounts of leverage, your equity P/L tracks your net pips P/L

Though we place trades in hopes of it working out in our favor, we must also be prepared if it doesn’t. Part of that preparedness is a result of determining an appropriate amount of effective leverage.

At DailyFX, we talk about using less than 10 times effective leverage.

That way, when you are wrong on a trade, you still have the majority of

your account capital remaining.

Written by Jeremy Wagner, Head Trading Instructor, DailyFX Education.

Trade Forex Like a Pro- Revealed the secret of

the floor traders, How you will be successful trading forex using price.

This is proven method tested that is making over $1,250 Monthly. No

sorry, no complicated calculation.

This is as simple as "ABC"

B