The key to making money in the currency exchange market is to avoid

emotional decisions and to follow a carefully thought out strategy that

takes the current market and history into account. Going with your gut

is not the way to go in the Forex market. Going with your gut could cost

you money. Forex trading is a highly volatile market where emotions

tend to run high. Emotions can influence your trading decisions, unless

you have a strategy planned in advance, and stick to it, no matter what

you think you're seeing at the moment. The keys to success in Forex are

system, analysis and perseverance.

Most experienced traders tell novice traders that they need to

develop a system — and stick to it no matter what. Letting your emotions

rule your decisions can hurt your trading in a number of ways. The

system tells you when to buy, what to buy, when to trade and what to

trade for. By sticking to your system you'll maximize your profits. A

system based on technical analysis of historical market trends is one of

the most potent tools that you can utilize if you're just getting

started in Forex trading. Many traders, with years of experience,

continue to use this system to keep the profits rolling in. Many traders

will tell you that when their gut instinct and their system collide,

the system is almost always right.

Using a mechanical system takes the emotion out of your trading,

eliminating one of the reasons people fail. Your system doesn't sway

with emotions. It sticks to a tried and true course. To be effective,

your system — whether you develop your own or adopt one created by

someone else — should identify the entry and exit point of your trade,

mitigating factors, and an exit strategy. In general terms this is as

follows:

Under what conditions should I acquire a currency?

For instance, you may have a buy order for when a particular

currency drops more than 5 pips because your analysis tells you that

that's likely to be as low as it goes.

When should I trade one currency for another and for which one?

There are two reasons to exit — to maximize your profit, or

minimize your loss. That means you have a set stop-loss order and a set

take-profit order at which point you cash out your trade.

What factors will I allow to change that decision?

While the money market moves in predictable patterns, there are

always individual variations of a trend within those patterns. If you've

taken those variations into account, it will be far easier to decide

when a factor really does make a difference, and when it's just wishful

thinking. If you're not careful however this is where emotion could come

into play and sour deals for you.

How will I trade out of a currency?

Your exit strategy may be as simple as a stop-loss order when my loss hits 5% or a take-profit order when I make 40% profit'.

Another key is perseverance. Analysis of trends in the market

will show you that the market moves in dips and spurts within overall

patterns that are predictable. No trend moves smoothly in an up or down

line — there are inevitable periods of time when values suddenly spiral

up or down based on some outside factor.

These are the times when

emotion can hurt your portfolio. When a currency that you're holding

takes a sudden dip south, it's tempting to succumb to panic trading, cut

your losses and run even if your system tells you to hold on. On the

other hand, it's easy to catch the rising excitement as a trade starts

increasing in value and scramble to buy more of the same. These are

exactly the times to rely most heavily on your trading system. It will

tell you exactly when to trade for maximum profit.

If you control your emotions and stick to the system you'll maximize your profits and all should be smooth sailing. by David Mclauchlan

Learn to analyze day trading stock, online day trading, day trading software and online Forex trading. We focus on different aspects of Technical, Fundamentals analysis and Forex robot.

Translate

Sunday, October 20, 2013

Forex Trading Is Driven By Five Top Economic Indicators

Many factors affect Forex trading. It is critical to know and

understand the various factors that cause the Forex to fluctuate from

day to day. The foreign exchange market will change depending on the

economic factors that play a role in the movement of currency. Guest post by David Mclauchlan

Economic factors and indicators are released by the government or by private organizations that can look in depth at economic performances. These indicators can be used to analyse economic performances from any country. The economic reports measure a country's economic health, in addition to government policies and current events.

For the most part, a reputable broker can look at economic indicators and know which trades will be best. Reports on these indicators are released at scheduled times and can tell if a certain country is experiencing improvement in the economy or if the country's economy is on the decline. When the prices fluctuate, a great deal one way or the other, the price can be affected.

Current events and the state of the economy in any given nation is one of the top economic indicators used when analyzing the Forex. Factors such as unemployment numbers, housing statistics and the current state of a country's government can all affect changes in the Forex. When a country is feeling optimisitic about the current state of affairs in their country, prices of the Forex will reflect this. When a nation experiences political unrest, large amounts of unemployed workers and inflation, the rate of the currency will be reflected. Sometimes, this indicator tends to be overlooked, but can serve as an important gauge in the fluctuations of the Forex.

The gross domestic product,or GDP,is another economic indicator used when looking at the foreign exchange market. The GDP is considered the widest and broadest measure of the economy in a country. The gross domestic product represents the total market value of all goods and services that are normally produced within any given country. This is usually measured in the time frame of a year, and not in weeks or months. Using a larger time period gives good statistics on the products and services that are produced in the country. This indicator is not used alone when forecasting the Forex. The GDP is considered a lagging indicator, meaning that is a measurable factor that changes after the economy has already began to follow a certain trend.

Retail sales reports are the third economic factor that is often used in analyzing the Forex. This is the total receipt of all retail stores in any country. Usually, this measurement is not every single retail sale, but is a sample of diverse retail stores throughout the country. This is considered a very reliable and important economic indicator because of the consumer spending patterns that are expected throughout the year. This factor is usually more important that lagging indicators and gives a clearer picture of the state of the economy in any country.

Another reliable economic indicator in the foreign exchange market is the industrial production report. This report shows the fluctuation in productions in industries such as factories, and utilities. The report looks at actual production in relation to what the production capacity potential is over a period of time. When a country is producing at a maximum capacity it positively affects the Forex and is considered ideal conditions for traders.

The consumer price index, or the CPI, is the last critical economic indicator in analyzing the Forex. The CPI is the measure of the change in the prices of consumer goods in 200 categories. This report can tell whether or not a country is making or losing money on their products and services. The exports that a country has are very important when looking at this indicator because the amount of exports can reflect a currency's weakness or its strength.

The Forex is affected by many factors. These factors usually follow a certain trend so it is important to understand how each factor works in forecasting the Forex. Some are good indicators alone while others should be used together for accurate Forex predications.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

Economic factors and indicators are released by the government or by private organizations that can look in depth at economic performances. These indicators can be used to analyse economic performances from any country. The economic reports measure a country's economic health, in addition to government policies and current events.

For the most part, a reputable broker can look at economic indicators and know which trades will be best. Reports on these indicators are released at scheduled times and can tell if a certain country is experiencing improvement in the economy or if the country's economy is on the decline. When the prices fluctuate, a great deal one way or the other, the price can be affected.

Current events and the state of the economy in any given nation is one of the top economic indicators used when analyzing the Forex. Factors such as unemployment numbers, housing statistics and the current state of a country's government can all affect changes in the Forex. When a country is feeling optimisitic about the current state of affairs in their country, prices of the Forex will reflect this. When a nation experiences political unrest, large amounts of unemployed workers and inflation, the rate of the currency will be reflected. Sometimes, this indicator tends to be overlooked, but can serve as an important gauge in the fluctuations of the Forex.

The gross domestic product,or GDP,is another economic indicator used when looking at the foreign exchange market. The GDP is considered the widest and broadest measure of the economy in a country. The gross domestic product represents the total market value of all goods and services that are normally produced within any given country. This is usually measured in the time frame of a year, and not in weeks or months. Using a larger time period gives good statistics on the products and services that are produced in the country. This indicator is not used alone when forecasting the Forex. The GDP is considered a lagging indicator, meaning that is a measurable factor that changes after the economy has already began to follow a certain trend.

Retail sales reports are the third economic factor that is often used in analyzing the Forex. This is the total receipt of all retail stores in any country. Usually, this measurement is not every single retail sale, but is a sample of diverse retail stores throughout the country. This is considered a very reliable and important economic indicator because of the consumer spending patterns that are expected throughout the year. This factor is usually more important that lagging indicators and gives a clearer picture of the state of the economy in any country.

Another reliable economic indicator in the foreign exchange market is the industrial production report. This report shows the fluctuation in productions in industries such as factories, and utilities. The report looks at actual production in relation to what the production capacity potential is over a period of time. When a country is producing at a maximum capacity it positively affects the Forex and is considered ideal conditions for traders.

The consumer price index, or the CPI, is the last critical economic indicator in analyzing the Forex. The CPI is the measure of the change in the prices of consumer goods in 200 categories. This report can tell whether or not a country is making or losing money on their products and services. The exports that a country has are very important when looking at this indicator because the amount of exports can reflect a currency's weakness or its strength.

The Forex is affected by many factors. These factors usually follow a certain trend so it is important to understand how each factor works in forecasting the Forex. Some are good indicators alone while others should be used together for accurate Forex predications.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

Saturday, October 19, 2013

Why You Should Treat Forex Trading as a Business

If you trade the forex market you will undoubtedly be aware that it

is a high risk venture. Most traders who trade currencies end up losing

money. Unfortunately, some traders end up losing a substantial part of

their net worth. By Eric Martin

Many traders, especially new traders are attracted to forex because they see brokers offering "500 to 1 leverage" and in some cases even higher amounts. It is a common belief amongst new traders that they can use this leverage to generate a substantial amount of wealth. This belief nearly always ends in tears.

To be a successful forex trader, it is imperative that you treat trading like a business. It is unlikely that you could put $50 in to a business and turn it into $20,000 in a short frame of time. Granted, there are exceptions, but they are EXTREMELY few and far between.

You need to apply this same theory to forex trading. One of the biggest reasons traders lose money is having an account size that is too small.

One of the major advantages is forex is that you can effectively borrow as much money as you like from your broker. However, it is important to remember that borrowing money to trade will increase your profits, but it will also increase your losses.

There are no universal rules to state how much you should borrow. Many new traders should start off borrowing very little, if anything. Of course, it does depend on the type of strategy that you use.

If you have a $10,000 trading account, most brokers would allow you to open positions to the value of at least $500,000. If you bought a USD pair, this would be 50:1 leverage. The position size is 50 times the size of your account.

It would not take much of a price movement in the wrong direction to cause a significant loss to your account.

Many new traders start with a small account balance. The same principle can be applied to a $100 account trading a $5,000 position.

The smallest position allowed by many brokers is often $10,000, yet they may still allow you to open an account with $100.

The brokers don't mind, they know that 99% of the clients who do this will blow their account.

The point I am trying to get across is the one of being realistic. Treat trading as if it is a business. Aim for realistic returns. Think about the stock market or mutual funds. They often earn less than 10% per year on average. If you can make 30% per year trading forex, that is significantly higher!

Don't expect to make $1,000 a month from your $100 account. It almost certainly will NOT happen.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

Many traders, especially new traders are attracted to forex because they see brokers offering "500 to 1 leverage" and in some cases even higher amounts. It is a common belief amongst new traders that they can use this leverage to generate a substantial amount of wealth. This belief nearly always ends in tears.

To be a successful forex trader, it is imperative that you treat trading like a business. It is unlikely that you could put $50 in to a business and turn it into $20,000 in a short frame of time. Granted, there are exceptions, but they are EXTREMELY few and far between.

You need to apply this same theory to forex trading. One of the biggest reasons traders lose money is having an account size that is too small.

One of the major advantages is forex is that you can effectively borrow as much money as you like from your broker. However, it is important to remember that borrowing money to trade will increase your profits, but it will also increase your losses.

There are no universal rules to state how much you should borrow. Many new traders should start off borrowing very little, if anything. Of course, it does depend on the type of strategy that you use.

If you have a $10,000 trading account, most brokers would allow you to open positions to the value of at least $500,000. If you bought a USD pair, this would be 50:1 leverage. The position size is 50 times the size of your account.

It would not take much of a price movement in the wrong direction to cause a significant loss to your account.

Many new traders start with a small account balance. The same principle can be applied to a $100 account trading a $5,000 position.

The smallest position allowed by many brokers is often $10,000, yet they may still allow you to open an account with $100.

The brokers don't mind, they know that 99% of the clients who do this will blow their account.

The point I am trying to get across is the one of being realistic. Treat trading as if it is a business. Aim for realistic returns. Think about the stock market or mutual funds. They often earn less than 10% per year on average. If you can make 30% per year trading forex, that is significantly higher!

Don't expect to make $1,000 a month from your $100 account. It almost certainly will NOT happen.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

How To Trade Trends With Ichimoku Clouds

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile

indicator that defines support and resistance, identifies trend

direction, gauges momentum and provides trading signals. Ichimoku Kinko

Hyo translates into "one look equilibrium chart". With one look,

chartists can identify the trend and look for potential signals within

that trend. The indicator was developed by Goichi Hosoda, a journalist,

and published in his 1969 book. Even though the Ichimoku Cloud may seem

complicated when viewed on the price chart, it is really a straight

forward indicator that is very usable. It was, after all, created by a

journalist, not a rocket scientist! Moreover, the concepts are easy to

understand and the signals are well-defined.

This tutorial will use the English equivalents when explaining the various plots. The chart below shows the Dow Industrials with the Ichimoku Cloud plots. The Conversion Line (blue) is the fastest and most sensitive line. Notice that it follows price action the closest. The Base Line (red) trails the faster Conversion Line, but follows price action pretty well. The relationship between the Conversion Line and Base Line is similar to the relationship between a 9-day moving average and 26-day moving average. The 9-day is faster and more closely follows the price plot. The 26-day is slower and lags behind the 9-day. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD.

There are two ways to identify the overall trend using the Cloud. First, the trend is up when prices are above the Cloud, down when prices are below the Cloud and flat when prices are in the Cloud. Second, the uptrend is strengthened when the Leading Span A (green cloud line) is rising and above the Leading Span B (red cloud line). This situation produces a green Cloud. Conversely, a downtrend is reinforced when the Leading Span A (green cloud line) is falling and below the Leading Span B (red cloud line). This situation produces a red Cloud. Because the Cloud is shifted forward 26 days, it also provides a glimpse of future support or resistance.

Chart 2 shows IBM with a focus on the uptrend and the Cloud. First, notice that IBM was in an uptrend from June to January as it traded above the Cloud. Second, notice how the Cloud offered support in July, early October and early November. Third, notice how the Cloud provides a glimpse of future resistance. Remember, the entire Cloud is shifted forward 26 days. This means it is plotted 26 days ahead of the last price point to indicate future support or resistance.

Chart 3 shows Boeing (BA) with a focus on the downtrend and the cloud. The trend changed when Boeing broke below Cloud support in June. The Cloud changed from green to red when the Leading Span A (green) moved below the Leading Span B (red) in July. The cloud break represented the first trend change signal, while the color change represented the second trend change signal. Notice how the Cloud then acted as resistance in August and January.

Chart 5 shows AT&T (T) producing a bearish signal within a downtrend. First, the trend was down as the stock was trading below the Cloud and the Cloud was red. After a sideways bounce in August, the Conversion Line moved above the Base Line to enable the setup. This did not last long as the Conversion Line moved back below the Base Line to trigger a bearish signal on September 15th.

Chart 7 shows DR Horton (DHI) producing two bearish signals within a downtrend. With the stock trading below the red cloud, prices bounced above the Base Line (red) to enable the setup. This move created a short-term overbought situation within a bigger downtrend. The bounce ended when prices moved back below the Base Line to trigger the bearish signal.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

How To Calculate Ichimoku Clouds

Four of the five plots within the Ichimoku Cloud are based on the average of the high and low over a given period of time. For example, the first plot is simply an average of the 9-day high and 9-day low. Before computers were widely available, it would have been easier to calculate this high-low average rather than a 9-day moving average. The Ichimoku Cloud consists of five plots:This tutorial will use the English equivalents when explaining the various plots. The chart below shows the Dow Industrials with the Ichimoku Cloud plots. The Conversion Line (blue) is the fastest and most sensitive line. Notice that it follows price action the closest. The Base Line (red) trails the faster Conversion Line, but follows price action pretty well. The relationship between the Conversion Line and Base Line is similar to the relationship between a 9-day moving average and 26-day moving average. The 9-day is faster and more closely follows the price plot. The 26-day is slower and lags behind the 9-day. Incidentally, notice that 9 and 26 are the same periods used to calculate MACD.

Analyzing the Cloud

The Cloud (Kumo) is the most prominent feature of the Ichimoku Cloud plots. The Leading Span A (green) and Leading Span B (red) form the Cloud. The Leading Span A is the average of the Conversion Line and the Base Line. Because the Conversion Line and Base Line are calculated with 9 and 26 periods, respectively, the green Cloud boundary moves faster than the red Cloud boundary, which is the average of the 52-day high and the 52-day low. It is the same principle with moving averages. Shorter moving averages are more sensitive and faster than longer moving averages.There are two ways to identify the overall trend using the Cloud. First, the trend is up when prices are above the Cloud, down when prices are below the Cloud and flat when prices are in the Cloud. Second, the uptrend is strengthened when the Leading Span A (green cloud line) is rising and above the Leading Span B (red cloud line). This situation produces a green Cloud. Conversely, a downtrend is reinforced when the Leading Span A (green cloud line) is falling and below the Leading Span B (red cloud line). This situation produces a red Cloud. Because the Cloud is shifted forward 26 days, it also provides a glimpse of future support or resistance.

Chart 2 shows IBM with a focus on the uptrend and the Cloud. First, notice that IBM was in an uptrend from June to January as it traded above the Cloud. Second, notice how the Cloud offered support in July, early October and early November. Third, notice how the Cloud provides a glimpse of future resistance. Remember, the entire Cloud is shifted forward 26 days. This means it is plotted 26 days ahead of the last price point to indicate future support or resistance.

Chart 3 shows Boeing (BA) with a focus on the downtrend and the cloud. The trend changed when Boeing broke below Cloud support in June. The Cloud changed from green to red when the Leading Span A (green) moved below the Leading Span B (red) in July. The cloud break represented the first trend change signal, while the color change represented the second trend change signal. Notice how the Cloud then acted as resistance in August and January.

Trend and Signals

Price, the Conversion Line and the Base Line are used to identify faster, and more frequent, signals. It is important to remember that bullish signals are reinforced when prices are above the cloud and the cloud is green. Bearish signals are reinforced when prices are below the cloud and the cloud is red. In other words, bullish signals are preferred when the bigger trend is up (prices above green cloud), while bearish signals are preferred when the bigger trend is down (prices are below red cloud). This is the essence of trading in the direction of the bigger trend. Signals that are counter to the existing trend are deemed weaker. Short-term bullish signals within a long-term downtrend and short-term bearish signals within a long-term uptrend are less robust.Conversion-Base Line Signals

Chart 4 shows Kimberly Clark (KMB) producing two bullish signals within an uptrend. First, the trend was up because the stock was trading above the Cloud and the Cloud was green. The Conversion Line dipped below the Base Line for a few days in late June to enable the setup. A bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in July. The second signal occurred as the stock moved towards Cloud support. The Conversion Line moved below the Base Line in September to enable the setup. Another bullish crossover signal was triggered when the Conversion Line moved back above the Base Line in October. Sometimes it is hard to determine exact Conversion Line and Base Line levels on the price chart. For reference, these numbers are displayed in the upper left hand corner of each Sharpchart. As of the January 8 close, the Conversion Line was 62.62 (blue) and the Base Line was 63.71 (red).Chart 5 shows AT&T (T) producing a bearish signal within a downtrend. First, the trend was down as the stock was trading below the Cloud and the Cloud was red. After a sideways bounce in August, the Conversion Line moved above the Base Line to enable the setup. This did not last long as the Conversion Line moved back below the Base Line to trigger a bearish signal on September 15th.

Price-Base Line Signals

Chart 6 shows Disney producing two bullish signals within an uptrend. With the stock trading above the green cloud, prices moved below the Base Line (red) to enable the setup. This move represented a short-term oversold situation within a bigger uptrend. The pullback ended when prices moved back above the Base Line to trigger the bullish signal.Chart 7 shows DR Horton (DHI) producing two bearish signals within a downtrend. With the stock trading below the red cloud, prices bounced above the Base Line (red) to enable the setup. This move created a short-term overbought situation within a bigger downtrend. The bounce ended when prices moved back below the Base Line to trigger the bearish signal.

Signal Summary

This article features four bullish and four bearish signals derived

from the Ichimoku Cloud plots. The trend-following signals focus on the

Cloud, while the momentum signals focus on the Turning and Base Lines.

In general, movements above or below the cloud define the overall trend.

Within that trend, the Cloud changes color as the trend ebbs and flows.

Once the trend is identified, the Conversion Line and Base Line act

similar to MACD for signal generation. And finally, simple price

movements above or below the Base Line can be used to generate signals.

Bullish Signals:

Bullish Signals:

- Price moves above Cloud (trend)

- Cloud turns from red to green (ebb-flow within trend)

- Price Moves above the Base Line (momentum)

- Conversion Line moves above Base Line (momentum)

- Price moves below Cloud (trend)

- Cloud turns from green to red (ebb-flow within trend)

- Price Moves below Base Line (momentum)

- Conversion Line moves below Base Line (momentum)

Conclusions

The Ichimoku Cloud is a comprehensive indicator designed to produce

clear signals. Chartists can first determine the trend by using the

Cloud. Once the trend is established, appropriate signals can be

determined using the price plot, Conversion Line and Base Line. The

classic signal is to look for the Conversion Line to cross the Base

Line. While this signal can be effective, it can also be rare in a

strong trend. More signals can be found by looking for price to cross

the Base Line (of even the Conversion Line).

It is important to look for signals in the direction of the bigger trend. With the Cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the Cloud on a pullback or consolidation. Conversely, in a bigger downtrend, traders should be on alert for bearish signals when prices approach the Cloud on an oversold bounce or consolidation.

The Ichimoku Cloud can also be used in conjunction with other indicators. Traders can identify the trend using the Cloud and then use classic momentum oscillators to identify overbought or oversold conditions.

It is important to look for signals in the direction of the bigger trend. With the Cloud offering support in an uptrend, traders should also be on alert for bullish signals when prices approach the Cloud on a pullback or consolidation. Conversely, in a bigger downtrend, traders should be on alert for bearish signals when prices approach the Cloud on an oversold bounce or consolidation.

The Ichimoku Cloud can also be used in conjunction with other indicators. Traders can identify the trend using the Cloud and then use classic momentum oscillators to identify overbought or oversold conditions.

The Ichimoku Cloud indicator is available on SharpCharts by selecting

it as an indicator in the "Overlay" drop-down box. Default settings are 9

for the Conversion Line, 26 for the Base Line and 52 for the Leading

Span B. The Leading Span A is based on the Conversion Line and Base

Line. The number for the Base Line (26) is also used to move the Cloud

forward (26 days). These numbers can be adjusted to suit individual

trading and investing styles. Sometimes it is necessary to add extra

bars to the chart when increasing the Base Line, which also increases

the forward movement of the Cloud.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

Friday, October 18, 2013

Forexpathfinder indicator - After Government Shutdown USA Nonfarm Payroll and Other To Be Release Today (Friday, October 18)

Canada Core CPI - 8:30am NY time (Friday, October 18)

Change in the price of goods and services purchased by consumers also called Bank of Canada Core CPI, CPI Ex Volatile Items, excluding the 8 most volatile items is usually released monthly, about 20 days after the month ends; When Actual greater-than Forecast is Good for currency; Volatile items account for about a quarter of CPI but they tend to be very volatile and distort the underlying trend. The Bank of Canada pays most attention to the Core data - so do traders. This is among the few non-seasonally adjusted numbers reported on the calendar, as it's the calculation most commonly reported.

Important of It.

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate;

Forexpathfinder Trade Plan

USA Nonfarm Payroll - 8:30am NY time (Friday, October 18)

PLEASE MIND GOVERNMENT SHUTDOWN! THIS EVENT CAN BE DELAYED!

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

Change in the price of goods and services purchased by consumers also called Bank of Canada Core CPI, CPI Ex Volatile Items, excluding the 8 most volatile items is usually released monthly, about 20 days after the month ends; When Actual greater-than Forecast is Good for currency; Volatile items account for about a quarter of CPI but they tend to be very volatile and distort the underlying trend. The Bank of Canada pays most attention to the Core data - so do traders. This is among the few non-seasonally adjusted numbers reported on the calendar, as it's the calculation most commonly reported.

Important of It.

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate;

| Traded pair | Expected figure | Deviation trigger | ||

| USDCAD | 0.2 (%) | ±0.3 (%) |

| Buy | USDCAD | if actual figure is or is below | -0.1 (%) | ||

| Sell | USDCAD | if actual figure is or is above | 0.5 (%) |

Expected move during first 20 minutes after the release is 20 pips or more.

Forexpathfinder Signals Trade Plan

Forexpathfinder Signals Trade Plan

| Traded currency pair | : | USDCAD | ||

| Initial spike duration limit | : | 15 seconds | ||

| Initial spike price action threshold | : | 10 pips | ||

| Triggering retracement percentage | : | 40 % | ||

| Retracement duration limit | : | 40 seconds | ||

| Maximum trade hold time after release | : | 15 minutes | ||

| Stop loss | : | 10 pips | ||

| Take profit | : | 10 pips | ||

| Maximum spread | : | 2 pips |

- If between 08:30:00am and 08:30:15am, so during the first 15 seconds you see USDCAD move up or down by 10 pips or more, then enter in the direction of the initial spike at the very first 40% retracement if it doesn't take more than 40 seconds (till 08:30:40am) – and if spread is at 2 pips or less. Set stop/loss at 10 pips, and set take/profit at 10 pips immediately.

- If the move either up or down was less than 10 pips during the first 15 seconds, then the actual number of the report did not generate sufficient interest in the market, and you simply skip the trade.

- If by 08:45:00am, so 15 minutes after the report release, neither your stop/loss nor your take/profit points were hit, then close the trade automatically at market price of the time.

Forexpathfinder Trade Plan

USA Nonfarm Payroll - 8:30am NY time (Friday, October 18)

PLEASE MIND GOVERNMENT SHUTDOWN! THIS EVENT CAN BE DELAYED!

| Traded pair | Expected figure | Deviation trigger | ||

| USDJPY | 179 (k) | ±75 (k) |

| Buy | USDJPY | if actual figure is or is above | 254 (k) | ||

| Sell | USDJPY | if actual figure is or is below | 104 (k) |

Expected move during first 15 minutes after the release is 50 pips or more.

Details:

USA Nonfarm Payroll - 8:30am NY time (Friday, October 18)

--–––––————————————————————–––––--

USA Nonfarm Payroll - 8:30am NY time (Friday, October 18)

--–––––————————————————————–––––--

| Traded currency pair | : | USDJPY | ||

| Initial spike duration limit | : | 30 seconds | ||

| Initial spike price action threshold | : | 25 pips | ||

| Triggering retracement percentage | : | 30 % | ||

| Retracement duration limit | : | 90 seconds | ||

| Maximum trade hold time after release | : | 15 minutes | ||

| Stop loss | : | 15 pips | ||

| Take profit | : | 15 pips | ||

| Maximum spread | : | 3 pips |

- If between 08:30:00am and 08:30:30am, so during the first 30 seconds you see USDJPY move up or down by 25 pips or more, then enter in the direction of the initial spike at the very first 30% retracement if it doesn't take more than 90 seconds (till 08:31:30am) – and if spread is at 3 pips or less. Set stop/loss at 15 pips, and set take/profit at 15 pips immediately.

- If the move either up or down was less than 25 pips during the first 30 seconds, then the actual number of the report did not generate sufficient interest in the market, and you simply skip the trade.

- If by 08:45:00am, so 15 minutes after the report release, neither your stop/loss nor your take/profit points were hit, then close the trade automatically at market price of the time.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you will be successful trading forex using price. This is proven method tested that is making over $1,250 Monthly. No sorry, no complicated calculation. This is as simple as "ABC" B

Wednesday, October 16, 2013

Forexpathfinder News Trade Plan (Thursday, October 17)

What is news trading? How does forex news trading work?

Forexpathfinder News Trading can be extremely profitable if you have an understanding of fundamental analysis and have access to low latency forex trading software. Sounds too complex or expensive? Do not worry, Forexpathfinder analyst will help you to identify high-probability tradable economic news reports and advise on the trading strategy. You find all details on Here and if you want make pips easier you can find additional tools at Forexpathfinder Tactical Squad.

UK Retail Sales - 4:30am NY time (Thursday, October 17)

| Traded pair | Expected figure | Deviation trigger | ||

| GBPUSD | 0.5 (%) | ±0.4 (%) |

| Buy | GBPUSD | if actual figure is or is above | 0.9 (%) | ||

| Sell | GBPUSD | if actual figure is or is below | 0.1 (%) |

Expected move during first 20 minutes after the release is 20 pips or more.

Note

| Traded currency pair | : | GBPUSD | ||

| Initial spike duration limit | : | 15 seconds | ||

| Initial spike price action threshold | : | 12 pips | ||

| Triggering retracement percentage | : | 35 % | ||

| Retracement duration limit | : | 40 seconds | ||

| Maximum trade hold time after release | : | 10 minutes | ||

| Stop loss | : | 10 pips | ||

| Take profit | : | 10 pips | ||

| Maximum spread | : | 2 pips |

- If between 04:30:00am and 04:30:15am, so during the first 15 seconds you see GBPUSD move up or down by 12 pips or more, then enter in the direction of the initial spike at the very first 35% retracement if it doesn't take more than 40 seconds (till 04:30:40am) – and if spread is at 2 pips or less. Set stop/loss at 10 pips, and set take/profit at 10 pips immediately.

- If the move either up or down was less than 12 pips during the first 15 seconds, then the actual number of the report did not generate sufficient interest in the market, and you simply skip the trade.

- If by 04:40:00am, so 10 minutes after the report release, neither your stop/loss nor your take/profit points were hit, then close the trade automatically at market price of the time.

Trade Forex Like a Pro- Revealed the secret of the floor traders, How you

will be successful trading forex using price. This is proven method tested that

is making over $1,250 Monthly. No sorry, no complicated calculation. This is as

simple as "ABC" B

Tuesday, October 15, 2013

High Forex Leverage Can Make Or Mar Your Profitability

Article Summary: Many Forex strategies focus on entry and exit signals of a trade. This

article illustrates how traders can take the same signals, yet arrive

at different profit amounts. Therefore, determining an appropriate

amount of effective leverage is crucial to a comprehensive Forex trading

plan.

Many traders focus all of their energy on finding the right entry and exit signal but still end up losing in the end. Today, I want to illustrate how two traders (Bob and Ed) place the same trading signals in their Forex account, yet end up with different equity amounts.

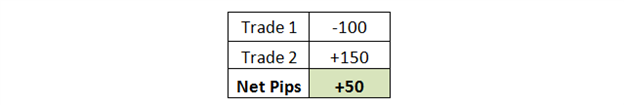

To keep the illustration simple, let’s look at a two trade series. Each trade has a 100 pip stop loss and a 150 pip profit target. The traders will lose on the first trade and win on the second trade. When you see the results on a score card, it would look something similar to this:

Trade results in pips

At the surface level, it looks like this trader is

doing well. They are maintaining a positive risk to reward ratio, they

have a good win ratio, and the number of pips collected on this series of two trades are positive 50 pips.

Now look at what happens to the account’s equity when Bob aggressively over leverages his account while Ed uses more conservative amounts of leverage.

Trader Bob

Starting Capital - $10,000

Account is set to 50:1 leverage. He thinks he is conservative and implements 40 times effective leverage.

Trade #

|

Trade Size

|

Value per Pip

|

Trade Result

|

Profit/Loss

|

Acct Equity

| ||

Trade 1

|

400,000

|

40

|

-100

|

-4000

|

6,000

| ||

Trade 2

|

240,000

|

24

|

150

|

3600

|

9,600

|

Hypothetical results for illustrative purposes only.

Notice how Bob’s two trade sequence netted him +50

pips yet he lost $400 in his account. Obviously, the second trade had a

much smaller trade size than the first, but when you over-leverage your

Forex account, any losing trade damages your capital base to the point

where you need to change your trade size or deposit more funds.

Trader Ed

Starting Capital - $10,000

Account is set to 50:1 leverage. Ed has gone through our Forexpathfinder EDU training materials and wanted to trade conservatively. He determined the appropriate amount of effective leverage for him was 5 times.

Trade #

|

Trade Size

|

Value per Pip

|

Trade Result

|

Profit/Loss

|

Acct Equity

| ||

Trade 1

|

50,000

|

5

|

-100

|

-500

|

9,500

| ||

Trade 2

|

47,000

|

4.7

|

150

|

705

|

10,205

|

Hypothetical results for illustrative purposes only.

Ed placed the same trades as Bob and had the same starting account balance as Bob, but Ed implemented a more conservative amount of leverage. His trade sizes were 1/8 the size of Bob’s yet:

- Ed ended up with higher equity relative to Bob

- Ed’s net profit/loss (P/L) was positive while Bob’s P/L was negative

Two points to take away from this illustration.

- When faced with a losing trade, high degrees of leverage destroy your capital base forcing you to change your future trade sizes or deposit more funds.

- When using conservative amounts of leverage, your equity P/L tracks your net pips P/L

Though we place trades in hopes of it working out in our favor, we must also be prepared if it doesn’t. Part of that preparedness is a result of determining an appropriate amount of effective leverage.

At DailyFX, we talk about using less than 10 times effective leverage.

That way, when you are wrong on a trade, you still have the majority of

your account capital remaining.

Written by Jeremy Wagner, Head Trading Instructor, DailyFX Education.

Trade Forex Like a Pro- Revealed the secret of

the floor traders, How you will be successful trading forex using price.

This is proven method tested that is making over $1,250 Monthly. No

sorry, no complicated calculation.

This is as simple as "ABC"

B

Subscribe to:

Posts (Atom)